I can appreciate the difficulties being faced by those affected by the current COVID-19 pandemic. I wish everyone good health and am a firm believer, along with the many, that capitalism can take a back seat for the sake of public health and safety.

However, there is no denying that a hot topic is the current state of public equity markets and global economies. I am asked for my take on this constantly and wanted to share a little bit here in response.

Second-Order Effects

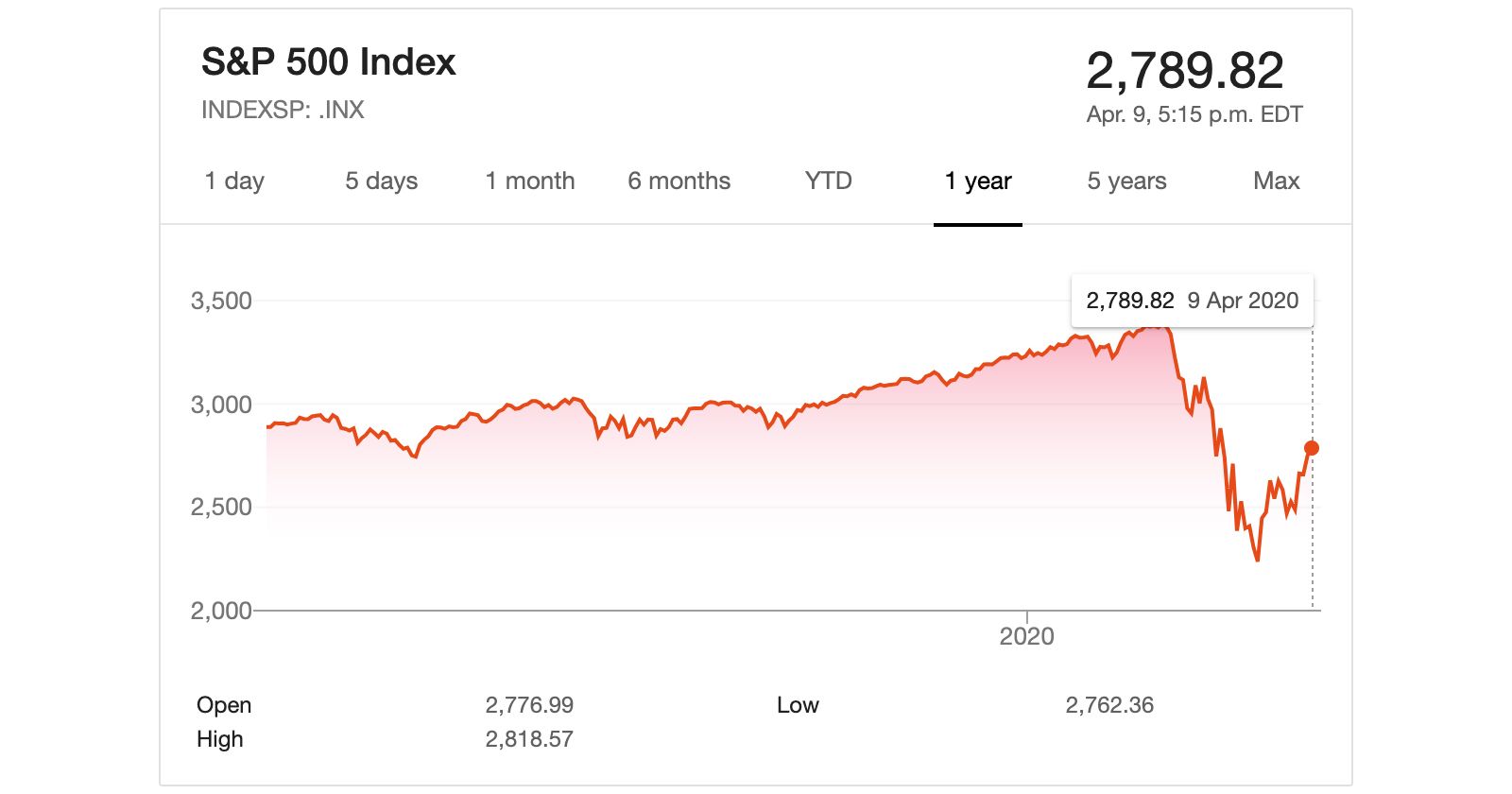

An unfortunate second-order consequence of the pandemic is decreased economic activity and job loss resulting from mandated "social distancing" and quarantine-like measures. Businesses with physical locations have been shut down, people are forced to work remotely or stop working altogether, consumers are forced to make purchases online, supply chains have been disrupted and the list goes on. Investors have panic sold and panic purchased all within the past few weeks. All of this can also result in some hefty unrealized losses in your traditional investments:

Risk tolerance and relative value

In addressing these effects, you can follow the news closely and do your own research or you can rely on your usual investment advisor. Anyone telling you they know what is happening is too confident. Your skepticism of experts should be at an all time high. In a lower risk portfolios, experts with hedging ideas are likely on the right path. I repeat: "hedging".

Hopefully, your portfolio risk profile allows you to whether the storm. The prevailing opinion amongst professionals is to ride out your current investments over the next few years while economies recover. This strategy is based entirely on the theory that the pandemic and the associated downturn is temporary. Long term value investors have never been wrong and I am not going to start disagreeing now. Just keep in mind that long term value investors like "Warren Buffet" are making moves.

With a lower risk tolerance I can say with certainty that attempting to "time the market" is a bad idea. Many argue that now is a great time to buy equities because everything is cheaper than it was 6-12 months ago. The classic problem of trying to find a bottom, "buying the dip" or as I like to call it: "catching the falling knife". I should clarify that within the context of long term value investing, buying now would be possible though using relative values as your only rationale would be foolish.

I believe that those relative values are important to consider but not everything in assessing where your future value and returns will come from. If you are going to attempt to get into the market at this point, you should have a more targeted and refined approach.

The Supposed Facts:

- Temporary stoppage - The current economic "halt" is deemed to be temporary. The unknown is how long the halt will last. There are some well documented estimates that are correlated with projected "Epidemiology Curves" of the disease.

- Government backstops - Governments everywhere have attempted to and succeeded so far in improving sentiment by guaranteeing aggressive monetary policy, fiscal policy and bailouts. Whether or not these programs will actually be effective has yet to be seen right now.

- Macro sentiment - Current market movements are driven strongly by overall sentiment. The majority of equity prices are tightly correlated with indices which may or may not be driven by the recent ETF Boom. I will talk about "separating winners from losers" as one of my suggestions.

- Specific industries - Some companies will feel the effects of the pandemic more than others. Brick and mortar retail, travel, tourism, restaurant and hospitality industries are front and center.

- Job loss - There are new reports of high unemployment numbers. Whether or not these losses are temporary is still debatable.

My approach has been to: (1) estimate the unknown variables surrounding the facts and then also (2) attempt to assess the market's response. I believe this can also form the basis for your research and understanding.

Macroeconomic response

Macroeconomics focuses on national output, unemployment, and inflation. The two main policy makers are governments and central banks. The major tools of macroeconomic policy makers are "fiscal policy" (government spending and taxation) and "monetary policy" (central bank control of the money supply). These tools are used to achieve "macroeconomic equilibrium" - knowing what macroeconomic equilibrium looks like here isn't really all that important.

There is the unprecedented occurrence of adverse supply/demand shocks all compounded by an exogenous fall in spending on goods and services because of (a) increased uncertainty (b) reduced wealth and (c) quarantine measures.

Quantifying the recent decisions in monetary and fiscal policy has been challenging because both levers have been pulled to their extremes. For monetary policy, interest rates are zero or near zero and the purchasing/issuing of debt feels unlimited. The numbers involved and execution in fiscal policy is not clear and I don't think anyone expects the deployment of stimulus to be efficient. There is also limited basis for comparison.

The policy makers are prepared to spend big in order to keep this economy afloat. The good news is that the overarching immediate goal has been to improve investor confidence and sentiment. I believe this goal has been achieved - at least temporarily.

The looming "Spiral" effect

The longer the pandemic persists, the less effective these macroeconomic measures will be. Also, the longer the pandemic persists, the sharper the impact on secondary industries. There are media outlets and pundits who are focused on retail, travel, tourism, restaurant and hospitality industries as the only losers. On the flip-side, virtual productivity software, healthcare, and drug companies are the winners. This is too simplistic in grappling with what a post-COVID-19 economy might look like.

Businesses are interconnected where you might not expect. Any planned capital and operating expenditure tightening for a struggling company will ripple through seemingly unrelated industries. Ex. Software companies may not be affected directly by the pandemic, but their customers may be across many industries are less likely to purchase or renew.

Laissez Faire? Don't you dare

Corporate and individual bailouts appear guaranteed at this point however the amount of money and the recipients are both vague. The US government has guaranteed more than $1.8 trillion of relief with more on the horizon.

Free market capitalists have never disagreed with "helicopter money" in times of need and there are many who enjoy pointing out the hypocrisy there. I do not agree with Chamath Palihapitiya on a lot of his policy ideas however I found his recent CNBC interview segment to sum up the alternative view point (it's also entertaining).

Chamath argues that "Corporate welfare" in the form of government's bestowal of grants, forgivable loans, tax incentives or other special favorable treatment for corporations is not needed. He points out that a finance version of natural selection will weed out unprepared businesses. Chamath further notes that employees will not bear the brunt of bankruptcy - speculators and investors will be the big losers, which is part of the "rules of the game".

Unemployment indicators

An animated graph titled “U.S. Weekly Initial Jobless Claims (thousands, seasonally adjusted)” went viral on social media and is shared below. Those numbers were real and originated with an April 3 2020 BLS report. However, they were not entirely reflective of reality in terms of genuine unemployment. Blanket stay-at-home orders and expansion of unemployment benefits to those temporarily furloughed or out-of-work were counted in, and an unknown number of people had yet to be counted.

Updated: Initial jobless claims as number 1/2 pic.twitter.com/VoQ3hye1LT

— 📈 𝙻𝚎𝚗 𝙺𝚒𝚎𝚏𝚎𝚛 📊 (@lenkiefer) April 2, 2020

It was further impossible to measure how many jobs would resume versus companies or businesses never to reopen, whether the scenario was stimulating or depressing the “gig economy,” and what the long term labor-related effects of the COVID-19 pandemic might be. Although the graph had underlying real numbers, they were hobbled by a myriad of immeasurable variables in an unprecedented situation.

Winners and losers

A somewhat less ambitious variation of the Efficient-market hypothesis is that all relevant public information is always reflected in market share prices and the market nearly instantly adjusts for any information once it becomes publicly known.

I am a strong believer that when the dust starts to settle, there will be more information about which companies perform better or worse than expected. The separation of winners or losers does not appear to be completely priced in to markets yet. As previously noted, current equity prices are tightly correlated to indices however certain sectors and businesses are affected more than others during this time. How can this be? Well markets can be irrational for long stretches of time.

Markets can stay irrational longer than you can stay solvent

- John Maynard Keynes

Building on this, it is obvious that certain Q1 and Q2 earnings calls for many companies will be terrible and yet their stock have not sold off. The current phase seems to be a repricing of general market "risk" but trading the news and information on individual companies is weak. This is where there is some opportunity to select a group of specific stocks and I suggest choosing wisely. I expect there to be extreme responses to Q1 and Q2 earnings calls. Reallocation of capital from weak to strong companies seems to be in its early stages.

New era of valuations?

In separating winners and losers, I am very interested to see how the market comes to a consensus on how to value companies. For the expense side, adjusted EBITDA is commonly accepted however how investors choose to model adjusted revenue will be key.

What about residential real estate?

The cost of borrowing for regular homebuyers or speculators has been low for a few years leading up to the pandemic causing increased sales and rising home prices. Borrowing costs are only decreasing with the pandemic response but it is interesting to note that prices in some major markets have leveled off at the end of Q1 2020. This could be an indicator or just a temporary supply problem caused by "social distancing". If unemployment causes a spike in supply relative to demand then real estate will only compound the problems markets are experiencing.

Slippery slopes and liquidity traps

Just want to leave a note here that there is serious risk to maintaining the current monetary policy after the pandemic has ended and companies/employment rates recover. Part of the reason monetary policy may not be as effective in this situation is because interest rates were arguably already too low heading in. Whether COVID-19 exposed a hidden "Liquidity trap" is a debate for another time.

Disclaimer: This article is opinion and is for information purposes only. It is not intended to be and should not be considered as investment advice. Seek a duly licensed professional for investment advice. Opinions are my own and not the views of my employer.

Thank you: Thank you to @mwood1089 for some very interesting and more candid (virtual) discussions around many of these topics. Also huge thank you to some friends and colleagues (you know who you are) for proofreads