The Berkshire Hathaway Annual Shareholder Meeting occurred a few weeks ago. For the first time, the meeting was streamed live and remote due to the Covid-19 pandemic.

As a shareholder and long-time fan of Buffett, I enjoyed the unexpected long-form introduction and the candid responses during the Q&A. Buffett talked for well over 4 hours and didn't miss a beat at age 89.

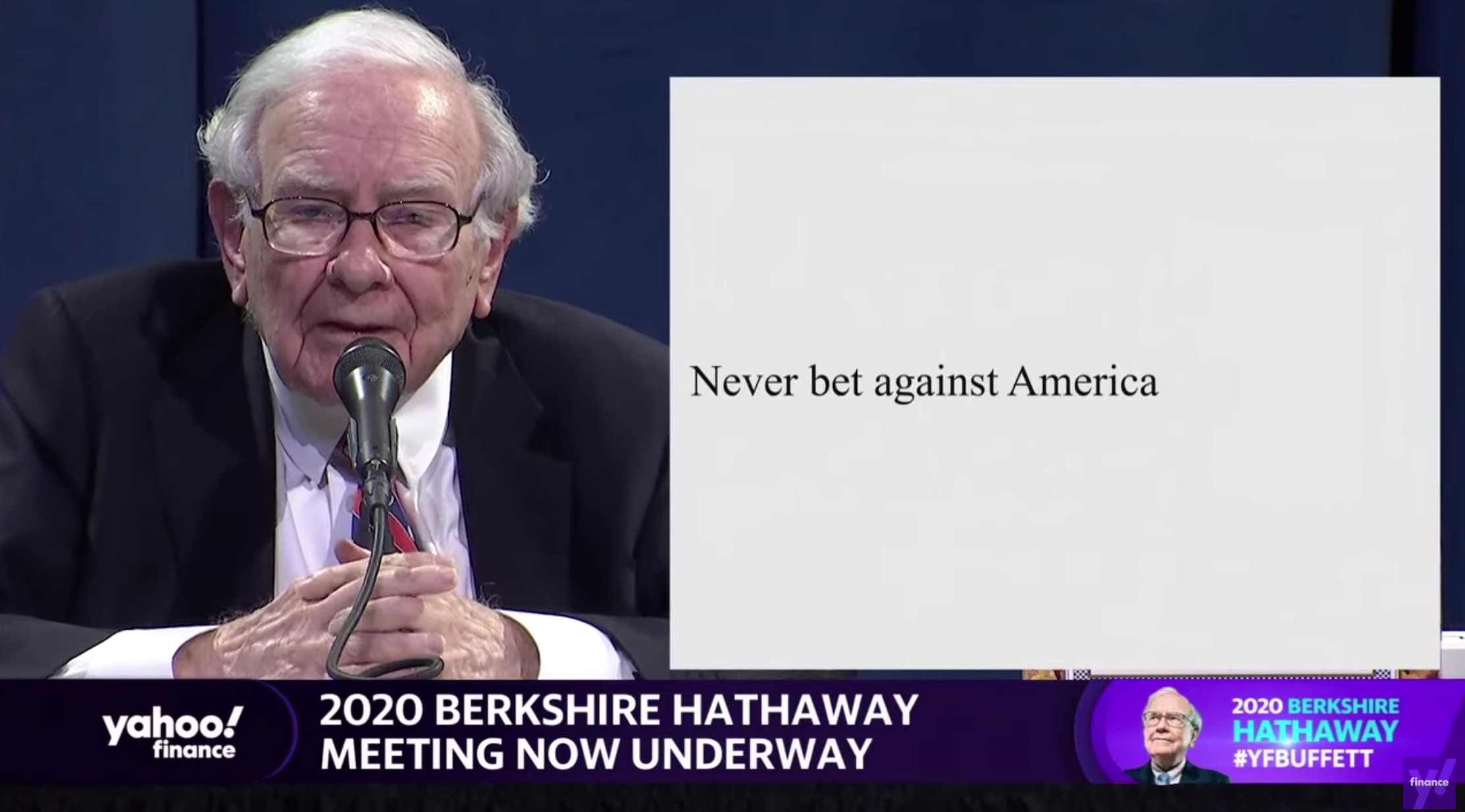

Even more interesting is that Buffett spent the first 30 minutes sharing a history lesson on the progress of American economy going back to the 1700's. As a famous long-term value investor, his pervasive message is that America succeeds over time. He provided multiple examples from American history where the country persevered through short/medium term problems.

"...if you bet on America and sustain that position for decades, you’re going to do better than, in my view, far better than owning Treasury securities"

I encourage you to watch or listen to the entire meeting here.

Taking notes

I make notes from the meeting every year and wanted to share an interesting excerpt from the 2020 edition. It does not pertain specifically to Berkshire or Covid-19. Within the context of "value investing", Warren uses a "farm ownership" analogy to explain how to stick to your own valuation methods and ignore the short-term pricing noise. Having a liquid market with realtime pricing for your investments is advantageous but no one is forcing you to sell at any given time.

Value your investment like a farm

Imagine for a moment that you decided to invest money now, and you bought a farm.

And the farmland around here, let’s say you bought 160 acres, and you bought it at x dollars per acre. The farmer next to you had 160 identical acres, same contour, same quality, soil quality, so it was identical. That farmer next door to you was a very peculiar character because every day that farmer with the identical farm said, “I’ll sell you my farm, or I’ll buy your farm at a certain price,” which he would name.

Now, that’s a very obliging neighbor. I mean, that’s got to be a plus to have a fellow like that with the next farm. You don’t get that with farms, you get it with stocks. You want 100 shares of General Motors, and then on Monday morning, somebody will buy you 100 shares or sell you another 100 shares at exactly the same price. And that goes on, I don’t know, five days a week.

But just imagine if you had a farmer doing that. When you bought the farm, you looked at what the farm would produce. That was what went through your mind. You were saying to yourself, “I’m paying x dollars per acre. I think I’ll get so many bushels of corn or soybeans on average, some years good, some years bad. Some years the price will be good. Some years the price will be bad,” etc.

But you think about the potential of the farm.

Now we get this idiot that buys the farm next to you, and on top of that, he’s sort of a manic depressive and drinks, maybe smokes a little pot. So his numbers just go all over the place. Now, the only thing you have to do is to remember that this guy next door is there to serve you and not to instruct you. You bought the farm because you thought the farm had the potential. You don’t really need a quote on it. If you bought in with John D. Rockefeller or Andrew Carnegie, etc. there were never any quotes. Well, there were quotes later on, but basically you bought into the business.

And that’s what you’re doing when you buy stocks.

But you get this added advantage that you do have this neighbor who you’re not obliged to listen to at all who is going to give you a price every day. And he’s going to have his ups and downs. And maybe he’ll name a selling price that they’ll buy at, and in which case you sell if you want to.Or maybe he’ll name a very low price, and you’ll buy his farm from him. But you don’t have to. You don’t want to put yourself in a position to where you have to.

So stocks have this enormous inherent advantage of people yelling out prices all the time to you, and many people turn that into a disadvantage. And of course many people can profit in one way or another from telling you that they can tell you what this farmer’s going to yell out tomorrow or next… your neighboring farmer’s going to yell out tomorrow, or next week, or next month.

There’s huge money it. So people tell you that it’s important, and they know, and that you should pay a lot of attention to their thoughts about what price changes should be, or you tell yourself that there should be this great difference. But the truth is, if you owned the businesses you liked prior to the virus arriving, it changes prices, and it changes, but nobody’s forcing you to sell. And if you really like the business, and you like the management you’re in with, and the business hasn’t fundamentally changed, and I’ll get to that a little when I report on Berkshire, which I will soon, I promise, the stocks have an enormous advantage. And you can bet on America.

But you can’t bet unless you’re willing and have an outlook to independently decide that you want to own a cross section of America, because I don’t think most people are in a position to pick single stocks; a few may be, but on balance, I think people are much better off buying a cross section of America and just forgetting about it. If you’d done that, if I’d done that when I’d got out of college, it’s all I had to do to make 100 for 1 and then collect dividends on top of it, which increased, would increase substantially over time.

The American tailwind is marvelous. American business represents, and it’s going to have interruptions, and you’re not going to foresee the interruption, and you don’t want to get yourself in a position where those interruptions can affect you either because you’re leveraged or because you’re psychologically unable to handle looking at a bunch of numbers.

If you really had a farm, and you had this neighbor, and one day he offered you $2,000 an acre, and the next day he offers you $1,200 an acre, and maybe the day after that he offers you $800 an acre, are you really going to feel that at $2,000 an acre when you had evaluated what the farm would produce, are you going to let this guy drive you into thinking, “I better sell because this number keeps coming in lower all the time”? It’s a very, very, very important matter to bring the right psychological approach to owning common stocks.

More interesting excerpts

- 3:13:19 Warren Buffet should you buy stocks

- 2:07:13 Using leverage to invest

- 2:11:53 Stocks vs. treasury bills

- 2:14:15 Stocks being part of businesses

- 2:24:51 Buffet uncertain about the near future

- 2:38:21 Buffet sends thank you letter to the Fed

- 2:41:24 Warren Buffet on selling airline stocks

- 3:38:42 When Warren Buffet decides to sell

- 4:02:10 Why index funds are recommended

- 4:08:35 Selling investments more profitable than managing

- 4:09:02 Warren Buffet’s response to his under-performance

- 4:14:29 The size of Berkshire Hathaway

- 4:26:34 Risk in oil markets

- 4:28:42 Warren Buffet on selling put options

- 4:37:45 Negative interest rates

- 4:48:25 US government bonds and printing money

- 4:51:11 Stock buy-backs

- 5:09:36 Warren Buffet advice on credit card debt

- 5:21:53 Warren Buffet on capitalism

Disclaimer: I've edited some of the transcript to make it easier to read. Any edits, omissions and other changes are not intended to create confusion or misrepresent the words of Warren Buffett