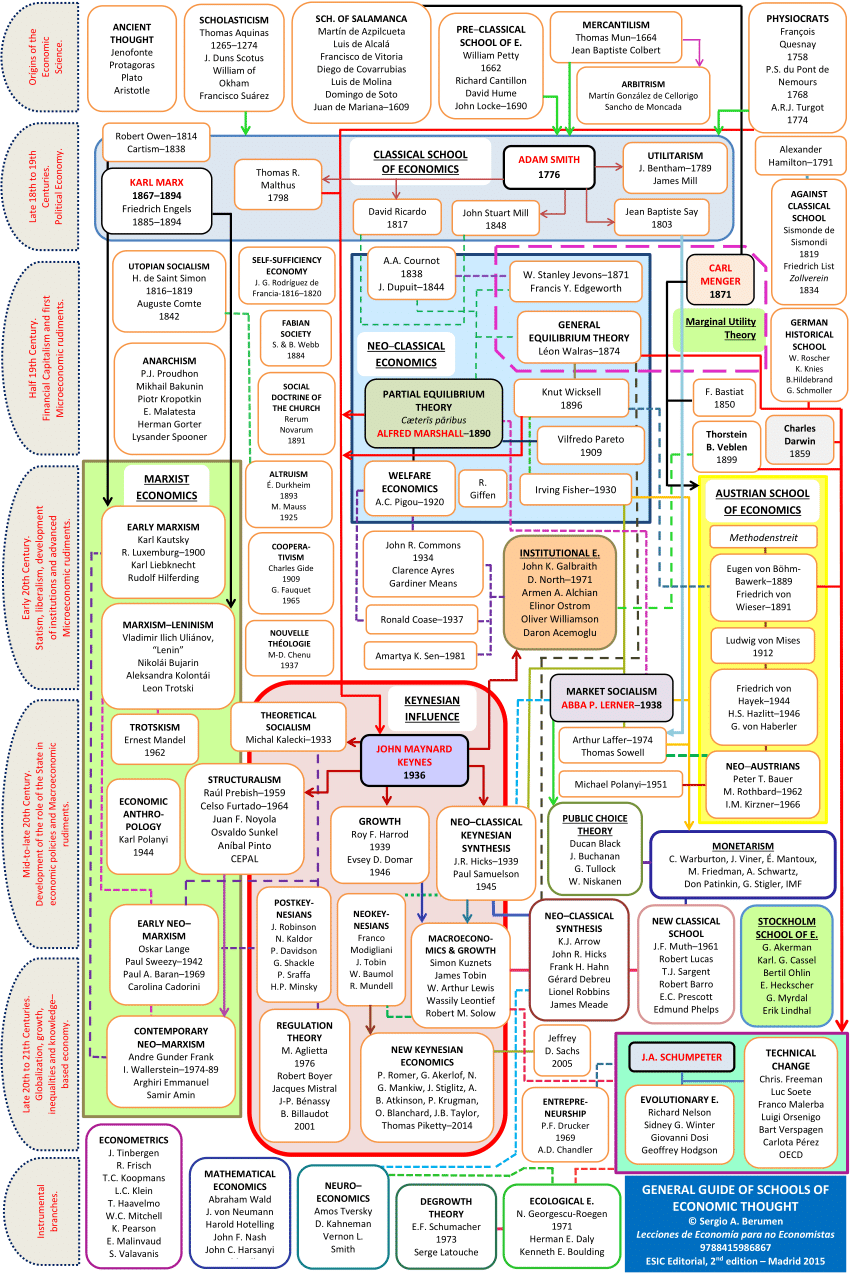

Over the past year I've noticed an interesting phenomenon - a rapidly growing number of people with an over-confidence in their understanding of macroeconomics. Invariably, they lean on and perpetuate the main branches of "mainstream" macroeconomics. The gap here is that there are not only other branches of mainstream macroeconomics but also other schools of thinking and "heterodox" macroeconomics that are just as valid. The danger therefore is in attempting to make predictions with that limited understanding. The secondary problem is that it piles on and makes prevailing frameworks socially reflexive and amplified where the better solution may be changing frameworks altogether.

Maybe the media and government communication are to blame. Maybe more people are trying to gain the relevant knowledge because macroeconomics is increasingly affecting their lives on a daily basis - asset prices, inflation etc. That is certainly commendable but consider this a wake-up call if you didn't know it already - Macroeconomics is a social science and it is a complicated one.

It's complicated

Macroeconomics is intertwined with human behavior and follows very different processes in its development than that of regular science and mathematics. The most critical will say that the more you study macroeconomics the more you realize it is currently a mash of voodoo complex systems and political narratives. Unfortunately, I tend to agree here. They will also say that today's macroeconomics is a form of cargo cult built on pseudo mathematics and political science to the point that it is "corrupted". Macroeconomic is not scientific because critical variables aren’t measurable, complexity is impossible to simplify, and predictions aren’t falsifiable.

"If You Spend 13 Minutes a Year on Economics, You've Wasted 10 Minutes"

- Peter Lynch

In the past, I've written articles to share more about mainstream macroeconomics because it can help tangentially with investment decisions. Basically making sure you "Don't fight the Fed" and can clearly see through the Overton window. I stopped posting these types of articles because there are an increasing number of resources available outside what I have to say - which is good, I think. If you read anything I've written on these topics, they all still hold up. Outside of thinking about "how does this affect my portfolio?" - it still remains that discourse around macroeconomics needs some serious improvement to avoid the problems with the status quo.

Macroeconomics ≠ Microeconomics

“Microeconomics is what you do, macroeconomics is what you put up with”

- Charlie Munger

An important distinction to make here is that macroeconomics should not be confused with microeconomics. Microeconomics and game theory are fundamental. I don’t think you can be successful in business or even navigating through most of our modern capital society without an adequate understanding of supply and demand, labor versus capital and game theory and tit for tat and those kinds of things.

Discourse

None of the real discourse around advancement in macroeconomics is in the public eye nor does the majority even know that the current macroeconomic thinking is not the only way forward.

Let me give an example of a statement I've heard repeatedly recently:

"Well the only thing they can do is raise interest rates because inflation is out of control. They need to force a recession."

The main problem with this claim is that there is almost a complacent, deterministic view under the current frameworks. It is in fact not "the only thing they can do." In actuality there are other factors to consider including that inflation is not measured accurately, market participants set prices (it is not all the invisible hand), there are other ways to reduce inflation etc. Also, how did we get to this point? Was the reflationary policies during the Covid-19 downturn too broad? Historically, raising interest rates has had success in reducing inflation so a question should be - do we have similar conditions to the 1970s?

Let's take another look at a statement from someone with a deeper understanding:

"This weird mix of monetarism and MMT is causing too much short-term volatility and government manipulation."

This claim is slightly better but amounts to complaining that the current framework. The question becomes, what is a better solution?

"You never have the counterexample on the economy. You can never take the US economy and run two different experiments at the same time. Because there’s so much data, people kind of cherry-pick for whatever political narrative they’re trying to push. To the extent that people spend all their time watching the macroeconomy or the fed forecasts or which way the stocks are going to go the next year, is it going to be a good year or bad year, that’s all junk. It’s no better than astrology. In fact, it’s probably even worse because it’s less entertaining. It’s just more stress-inducing. I think of macroeconomics as a junk science. All apologies to macroeconomists." - Naval Ravikant

Where are the economists?

In the past century, we have had the rise of macroeconomics as serious field of study and some prominent and important economists - Keynes and Hayek through the 1930s leading up to the latter half of the century with Friedman, Robert Mundell, Samuelson etc. While I may not agree with Friedman on many points of view, I do enjoy how he creates an environment for discussing and (vigorously) defending his views. (YouTube - "Milton Friedman - Tyranny of the Status Quo - Beneficiaries w/ David Brook")

Where can we explore competing schools of thought today?

- Podcasts - This type of discourse is currently available in podcasts but the most popular podcasts are those which are most entertaining, not those with the most serious and credentialed participants. Podcasts are also dismissed by mainstream media as inconsequential to the public discussion except for when it agrees with the popular opinion.

- Conferences and Interviews - The next best sources of discourse are conferences and interviews but where are the prominent economists with platforms to encourage public debate? Today it seems like the frontrunners would be Piketty, Krugman, Stiglitz etc. and it seems that their platforms are publications and panels like the one shared here (Youtube - "Thomas Piketty, Paul Krugman and Joseph Stiglitz: The Genius of Economics")

If we are to be more informed, it would seem natural that leading economists make better use of their platforms to promote discussion and critical thinking. Up until the 1980s, the prevailing macroeconomic school of thought was more fluid. Governments and policy makers experimented. Governments explained their plans to the populations with (just a little) more clarity than today. There was also more debate around which macroeconomic school to pursue where little choice is presented today.

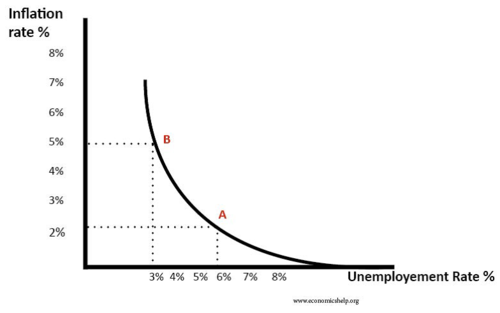

Example: The Phillips Curve

Perhaps the most famous example where developing policies on mainstream economics has led to poor outcomes is the Phillips Curve. It is also the most relevant example today given the inflation that we are experiencing in 2022.

The Phillips Curve goes back to 1958 when Bill Phillips a former crocodile hunter from New Zealand and academic at the London School of Economics published an article titled "The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957"

Looking at UK data between 1861 and 1957 it found an inverse relationship between the rate wages increased and the level of unemployment. Higher wage increases were associated with lower unemployment and a lower rate of wage increases were associated with higher unemployment - as increases in wages over this period were closely related to general price rises.

Ultimately what made the Phillips Curve so powerful and influential was that it came along at precisely the right time. Macroeconomists were developing new theories and models about how the economy worked and the evidence that Bill Phillips provided justified their theoretical musings. This was the heyday of Keynesianism in the 1950s when politicians encouraged by economists believe they could control the economy with monetary and fiscal policy. The Phillips Curve showed that the policy objectives of inflation and unemployment were in conflict or put another way - they had to make a choice low inflation or low unemployment.

By the 1970s though this relationship had broken down. Stagnant demand was causing high unemployment and at the same time there was high inflation - something the Phillips Curve did not foresee or predict. This combination of both high unemployment and high inflation became known as "stagflation." If the 1970s was about high inflation and high unemployment then by the mid 1990s the world was changing again - we started to see prolonged periods of low inflation and low unemployment. Further evidence that the relationship that Bill Phillips had spotted no longer existed.

So you may ask why do students still learn about the Phillips Curve - what's the point? Well it does remind us that although unemployment and inflation are related to the level of demand for goods and services in an economy there are many other factors that have a significant influence on both the rate of inflation and the level of unemployment.

Simplifications in economics are dangerous and rarely remain true forever. The Phillips Curve is nothing more than a loose statistical relationship on historical data. After all economics is a complicated social science it studies people and people can be unreliable and unpredictable.

Removing your delusion

Not everyone can devote a lot of time to macroeconomics, nor do I even recommend doing that. What is clear that we need to at least admit that mainstream macroeconomics is not the "only way" and promote public discourse and debate to hold leaders accountable. Professionals should be working to improving underlying data and rigor in macroeconomic research. In my opinion the latter won't happen without the former.

Engaging in conversation with at least these background ideas as starting points can help widen your view.

Disclaimer: This article is opinion and is for information purposes only. It is not intended to be and should not be considered as investment advice. Seek a duly licensed professional for investment advice. Opinions are my own and not the views of my employer.